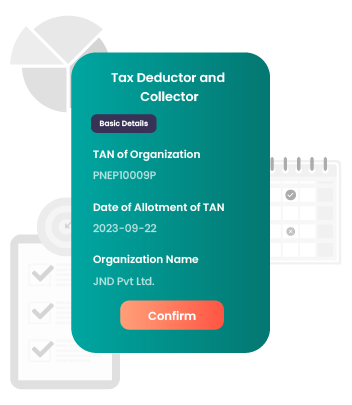

A platform for recording, reporting, and complying with Tax Deducted at Source.

We offers various user-friendly payment methods, such as online platforms, checks, and electronic funds transfer. Additionally, we provide access to expert guidance through consultation with a tax professional.

We recognize the complexities of financial situations and offer valuable insights into arranging structured payment plans and negotiating with tax authorities when full payment becomes unmanageable.

Government platform for Goods and Services Tax-related transactions and compliance.

A platform for recording, reporting, and complying with Tax Deducted at Source.

Online hub for Income Tax-related filings, returns, and taxpayer services.

Revolutionizing Tax Payment Solutions Tailored to Your Needs

Comprehending these dates is crucial to remitting taxes to the government, vital for funding public services. It involves calculating tax liability, reporting income, and making payments within specified deadlines.

Sequential steps from calculation to remittance of taxes to authorities.

Categories based on income, property, consumption, and more.

Tax payments finance essential government functions, healthcare, education, and defense.

Paying taxes ensures adherence to tax laws, reducing the risk of penalties or audits.

Taxes support safety nets and social programs, providing assistance to those in need.

Tax revenue helps maintain economic stability and fund public projects, promoting growth.

Tax payments contribute to a functioning society, fulfilling a civic duty.

Copyright @ ZEBICSOFT SOFTWARE TECHNOLOGY PRIVATE LIMITED. All Rights Reserved